California Businesses Fleeing the State

California Businesses Moving for Cost Savings Less Regulation

California’s Tax Base moving from the Golden State to the Lone Star State?

It’s hard to argue that California is a bad place for business. After all we have Hollywood, Silicon Valley, and a booming Real Estate Market–at least along the coast and in the bay area. But does that tell the entire story? What about all the not-so glamourous middle income jobs? Well it’s hard to get a complete picture of what’s going on because in the last couple of decades Silicon Valley has been happening in Silicon Valley. But most of us will never work in the Valley or Hollywood.

We decided to look at companies that provide a lot of well paying jobs that have moved away from California. And for each job they move out of state, there are lot more associated and support jobs that go along with them. I was struck by a comment a grandmother made. She said that I was all wrong. Young Californians are doing great–starting businesses and working for high tech companies–if you want to meet them go to Austin.

It’s really hard to see what’s going on because most companies don’t want to publicly bash California. It’s a huge market and you don’t want to get on the state government’s s***list Also, they will often expand in other states rather than California. They use public relation talk saying that they are committed to California but “they are expanding out-of-state, consolidating jobs to another state, or just downsizing here and expanding there.’

Is California’s tax burden driving employers out of the state? Well that’s a tough question to answer because it’s really hard to observe the tax burden paid by each business. There are direct taxes like income and car registration taxes, but what about the taxes you don’t realize you are paying. For instance sales taxes, excise taxes, and the costs of everyday goods and services that have been driven up because business owners must pay taxes. Also, how do you count businesses. Some are huge corporations and others are one man shops. We can never figure that out.

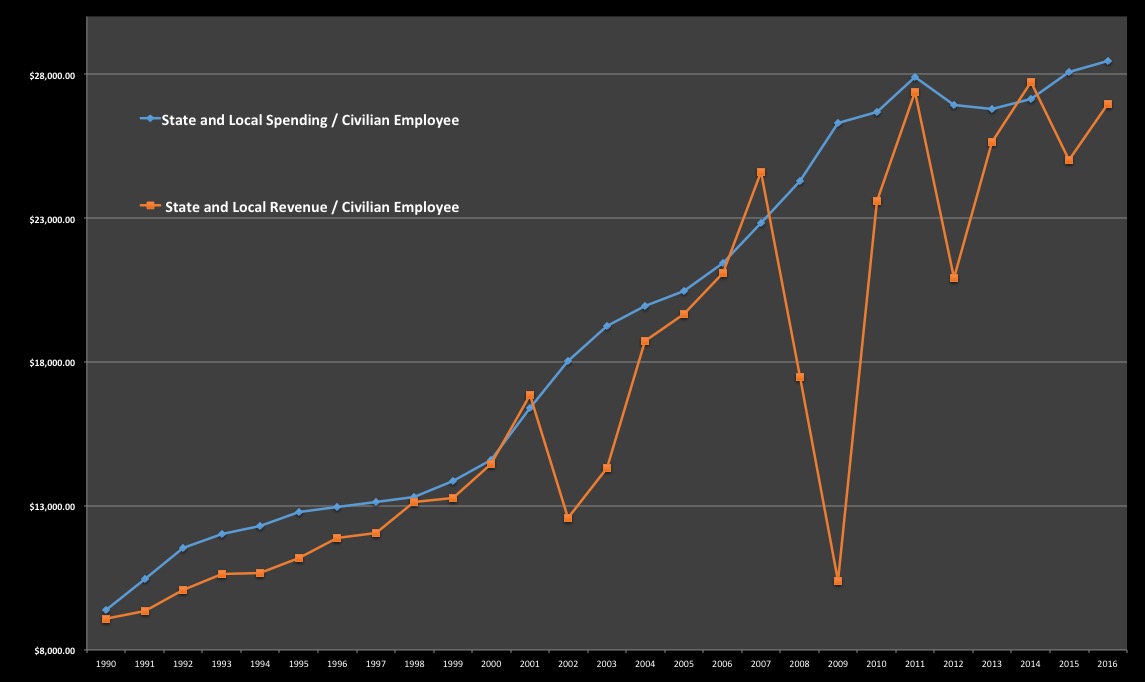

So we looked at it from the standpoint of a typical non-government employee. The graph above shows how the amount of spending done by the state and local governments per working person has increased and the amount of ‘revenue’ by the state and local governments has increased since 1990. Wow that’s a huge increase. For those remaining in California, the most relevant figure is the amount of spending as it will have to be paid back with taxes at some point.

And it does not include factors like California’s highest workers comp rates in the state, California’s high insurance rates. Both of these are driven by high liability costs which are like a tax because the government makes you pay them. Also it does not include unfunded costs. When a state or local government compensates people for services in a given year with a promise to pay in the future, but does not set money aside money to pay for the funds promised in the future. This is called an unfunded liability. California operates some a couple of the world’s biggest pension plans for its employees. And then there is the cost of regulations. And we are not putting away enough to pay the bills when they come due.

Just to ball park this, Spending per civilian employee has gone up by about 204% in the past 17 years, and revenue per civilian employee has gone up by about 197%. And to boot in 1990, people were complaining that California was a high tax state. Of course you might argue that businesses would want to stay because government services are twice as good as they were back in 1990–roads, schools, universities… I think you would lose that argument.

Another way to look at this is that each person working in the private sector must support $28,486/year of public sector spending on average.

Other Evidence that California is Taxing the middle class out of the state

We have heard stories of companies telling their employees that they are not moving to save money on salaries but other costs. We have heard about employers keeping wages the about same and paying people to move into new facilities — which duplicate the ones they already own in California — because of other costs.

Charles Schwab is moving operations for the Bay Area to a 100 Million dollar new facility in North Texas Link and Denver Link

State Farm Insurance Is expanding employment in Arizona, Texas, and Georgia. It’s closing/closed facilities in Bakersfield (about 4,200) Petaluma, and Irvine. Link

Kubota Tractor spent $50 million for their new HQ in Grapevine Texas. Link

Toyota

Data Sources:

EDD this data provides the number of private and public sector employees.

http://www.labormarketinfo.edd.ca.gov/geography/lmi-for-california.html Number of Employees

California Revenue

http://www.usgovernmentrevenue.com/revenue_chart_1990_2017CAb_18c1li111mcn_F0c

California Spending

http://www.usgovernmentspending.com/download_multi_year_1990_2017CAb_18c2li101mcn_F0t