Questions About MorningStar Data

Hi, this is a question about MorningStar Data. The Discussion pages at Morningstar have been offline for a while now.

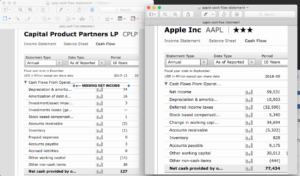

We are little confused about Your Cash flow statements. Per the Cash Flow Statements, I have noticed that a lot of companies start off with Net Income and then make adjustments; and I figured this was standard. But a while back, I noticed that the “net income” is missing from a lot of the statements. For instance, CPLP’s cash flow from operations is listed as $127, but this and their net income equaled $38. Shouldn’t that be included?

(I see the number 38 under “other non cash items” but I assume this is not their net income from the income statement.) For reference I have attached a copy of Apple’s cash flow statement, and it starts off with Net Income.

So do I have to adjust the Cash Flow statements for Net Income when It’s missing to make the numbers correct?

The MorningStar Team looked into this and came back with the following response:

MorningStar Response: Due to different accrual methods involved; yes, you would have to adjust. The reason for the difference between cash and profit is because the income statement is prepared under the accrual basis of accounting, where it matches revenues and expenses for the accounting period, even though revenues may actually not have yet been collected and expenses may not have yet been. Please let us know if you have any additional questions.

Yes I agree, that’s the point of the Cash Flow Statement. Many investors look at cash flow rather than income. But this did not quite answer my question. For some companies the net income numbers are missing from the cash flow statement. I have provided you with two Cash Flow statements from M* The one one on the right from Apple as an example starts off with Net Income as it should. The other one is from a small company, and I noticed that they just do the adjustments for net income rather than the adjustments to net income. Net income is missing which would indicate that the numbers on the cash flow statement are all off by the amount of net income that company made in each year.

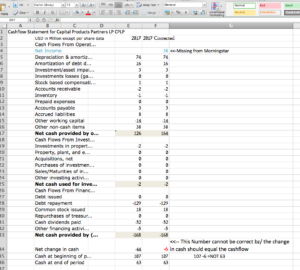

I went ahead and adjusted the cash flow statement as MorningStar had suggested, but that made things more confusing. It turns out that if you add in the net income for this small company, the cashflow changes significantly from -44 to -6. But the annual cash flow should equal the change in cash on the balance sheet. (e.g. if a company had $100 in cash at the beginning of the year and then had a cash flow of $100; the company should have $200 in cash at the end of the year.) When I adjusted the cash flow as suggested my morningstar, things did not balance out.

For the the firms where net income is not included in cash flow, what numbers are correct? Or is the Cash Flow statement off?

I have been avoiding companies that have been borrowing to fund dividends; but if the cash flow statements are off, maybe they were not borrowing to fund dividends.

So it’s not clear if the cash flows are off, or the balance sheet numbers are off, and thus the valuation metrics such as price/cash flow and price/book value are off. It’s frustrating because a lot of us use data on Mornignstar rather than just looking at the star ratings.

I used Microsoft Excel to calculate the new cash flow statement adjusting for missing net income as suggested by Moringstar. As you can see, the numbers just don’t add up.

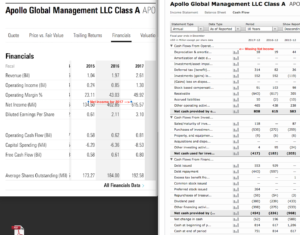

We found the same problem with Apollo. If you Adjust the cash flow statement for Net Income from the income statement, the change in cash holdings will not balance out. Thus we are not sure which metrics are correct. P/E would be correct, but all the metrics including balance sheet numbers, like price/book, might not be correct.